Diamond beneficiation new incentivization in Angola

Diamond beneficiation, Angolan Government Introduces New Incentivization to Promote

Diamond beneficiation is on the cards in Angola, four incentives have been introduced by the Angolan Ministry of Mineral Resources to support beneficiation manufacturing in the country.

The process works towards rewarding manufacturers and miners who take extra measures to treat materials further in their production chains. The four measures that have been introduced are as follows:

A 20% cut of the run-of-mine production is to be exclusively sold to beneficiation manufacturers. International customers will not have access to this 20% cut, except if beneficiation manufacturers do not meet sufficient technical or financial capabilities.

Introduction of a differentiated tax regime for the 20% cut exclusively sold to beneficiation manufacturers:

0.253% tax for the goods that are processed locally, out of the 20% run-of-mine cut exclusively sold to beneficiation manufacturers.

3.553% tax for the goods that are subsequently exported, out of the 20% run-of-mine cut exclusively sold to beneficiation manufacturers.

8.553% tax on the remaining 80% of the run-of-mine production available for export to international customers. Local manufacturers will be subject to the above-mentioned 0.253% and 3.553% tax rates when processing some of the remaining 80% of the run-of-mine production in Angola.

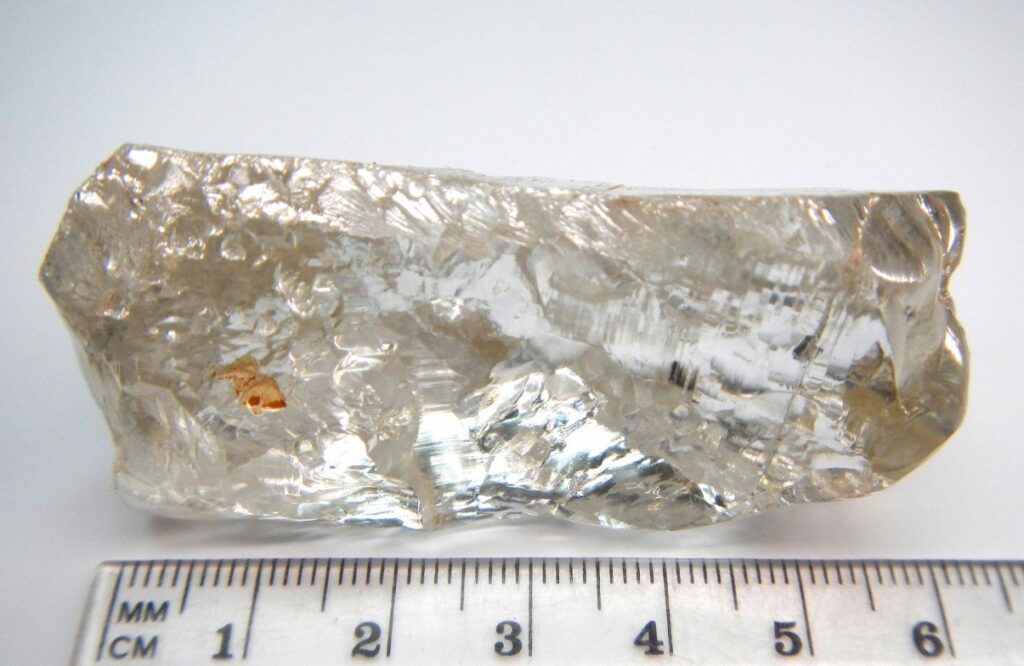

Obligation for beneficiation factories to locally process the stones deemed eligible according to the criteria established by ENDIAMA and SODIAM, the remaining non-eligible part of the run-of-mine production can be exported. The rough diamond qualities that are eligible for beneficiation manufacturing are the following:

For the following Categories

- 2ct and up: Z1, Z2, Z3, Z4, Spotted,

- MB 1, MB 2, MB 3, MB 4 with D to M colours

- 3-6grs: Z1, Z2, Z3, Z4, MB 1, MB 2, MB 3 with D to M colours

- sieves +11 and +9: Z1, Z2, MB 1, MB 2 with D to M colours

A new financial mechanism to mitigate the impact of the delay in VAT reimbursement associated with purchases will be applicable for beneficiation manufacturing operations upon certain requirements.

The implementation and monitoring of these incentives will be conducted by a technical group made of ENDIAMA and SODIAM.

The Angolan regulatory framework for investment in the mining sector is robust and investor friendly. An example of this robustness is the recent return of De Beers to Angola, a country that, in the words of De Beers’ CEO, “has worked hard in recent years to create a stable and attractive investment environment”. The company has signed two mineral investment contracts in 2022 for exploration and mining of diamonds in Angola. Industry leaders Alrosa, Rio Tinto and Anglo American also have significant investments in Angola in diamonds, copper, cobalt and nickel. Pensana Rare Earth’s Longonjo project is also worth noting. The Longonjo project is set to become the first large-scale neodymium and praseodymium (NdPr) rare earth mine in Africa, with a production target of 56,000 tonnes per year. The government is confident that these long-term investments in diversified minerals will attract a variety of other companies to invest in the country.

Angola is also focused on developing the country’s minerals processing industry. The Saurimo Diamond Development Hub inaugurated in August 2021 ‒ focused on converging into Saurimo the entire national diamond value chain – is an example and has been promoted by the Angolan government as the country’s final step towards the country’s quest to become a global diamond producer. Located on the road to the large Catoca diamond mine, the Saurimo Development Hub aims to significantly enhance the country’s diamond production capacity, enabling the processing and polishing of resources in addition to rough diamond exports.